Free Mortgage Agreement

Learn when and how to use a mortgage agreement during a property purchase, and create your own form.

-

1

Choose a form

Browse and select the document you need

-

2

Answer Questions

Go through our builder and complete your form in 5 minutes

-

3

Download & E-sign

Receive your document in PDF or Word format

Create Document

Create Document

- Download as PDF and Word

- Access from desktop, tablet & mobile

- E-signature

- Yearly Updates & Notifications

A Mortgage Agreement, also called a mortgage deed, is a legal contract between a borrower and lender. The mortgage agreement creates a lien on a property that secures the repayment of a loan.

This is a critical document for a transaction involving a loan to purchase property, as it helps protect a lender’s interest in the real estate.

Many landlords use mortgage agreements when buying and selling properties in their real estate business.

You may want to create your mortgage agreement and self-finance a sale, or you may need to purchase more property to build your business.

Either way, you can get the help you need with our mortgage agreement template.

What is a Mortgage Agreement?

Mortgage agreements are legal contracts between two parties:

- The first party to the contract is the borrower who wants to buy the property — the mortgagor.

- The other party is the lender supplying the money for the property purchase — the mortgagee.

A mortgage agreement creates a secured interest against the home to help enforce the loan and guarantee repayment.

This lien means that if the borrower fails to make payments or violates the mortgage agreement, the lender has the right to foreclose on the property.

A mortgage agreement is a powerful contract that provides a remedy, but you must document it in writing.

Why do you need a Mortgage Agreement?

You need a mortgage agreement anytime you buy or sell a property through a lender. This document outlines the essential details of a real estate loan and makes them legally enforceable.

Without an agreement, the terms of the sale (financing) may be unenforceable.

When do you use a Mortgage Agreement?

You will use a mortgage agreement if you are going to:

- Borrow money to purchase a property

- Lend money to a buyer to buy the property

- Manage a company that provides loans

Whether you borrow or lend money, you want to protect your legal rights with a quality mortgage agreement.

What to include in a Mortgage Agreement?

Each mortgage agreement will vary depending on the lender and other vital details. Some standard sections you should include in your mortgage agreement include:

- Contact information for the mortgagor and mortgagee

- Promises to repay the loan

- The amount borrowed (the principal)

- The interest rate

- The time in which to repay the loan

- Conditions of default or nonpayment

- Information about the property

With the correct legal document, you can protect your rights when buying and selling properties in your business.

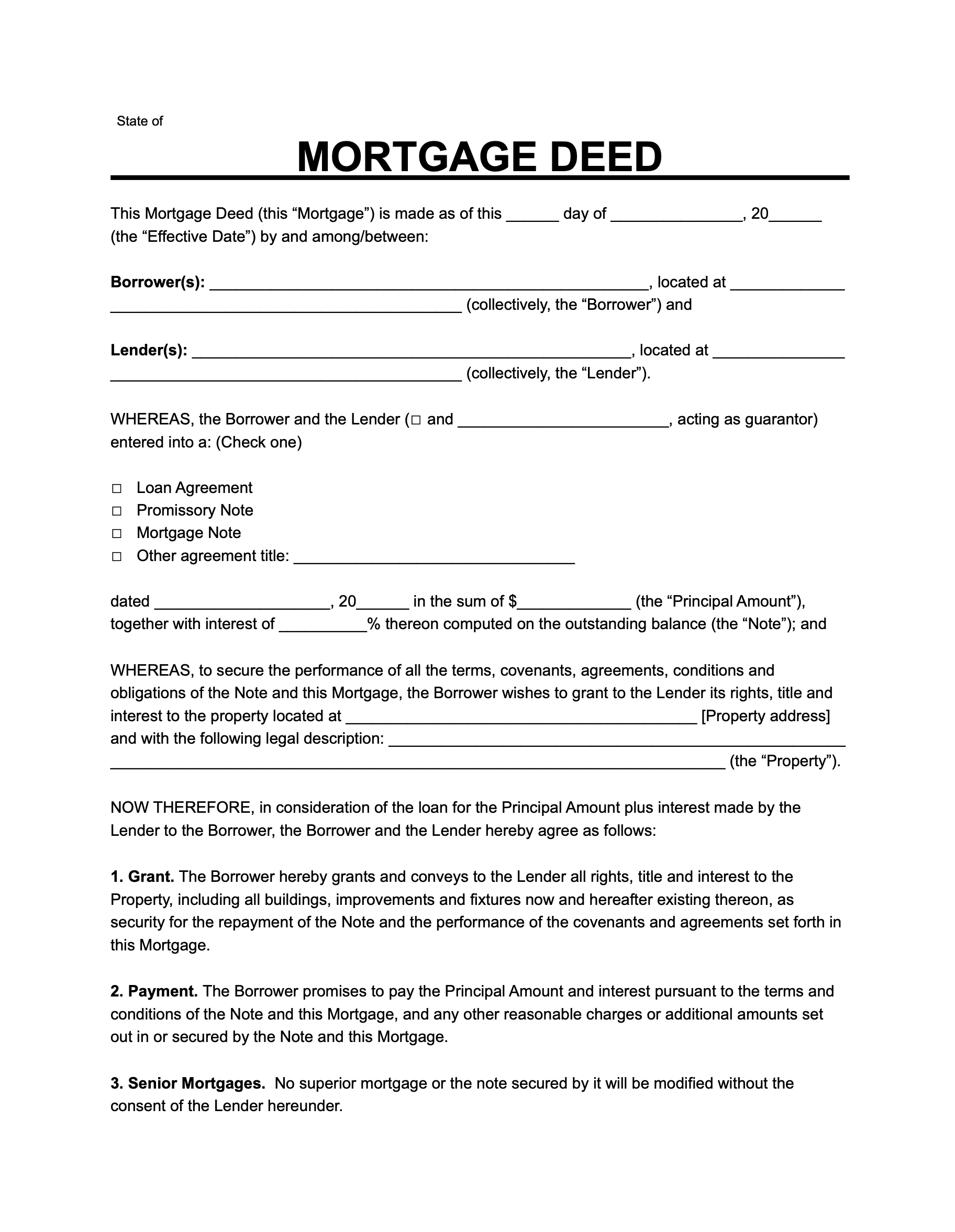

How to Write a Mortgage Deed

Follow the steps below to write a mortgage agreement.

Step 1 – Enter the State

Fill in the name of the state you make the agreement.

Step 2 – Write Borrower and Lender Details

Enter the borrower’s full name and include the borrower’s street address. Write the lender’s name and street address.

Step 3 – Document Loan Information

Note the name of the guarantor, the agreement, and the property principal amount.

Step 4 – Fill in Property Details

Specify the property address and legal description.

Step 5 – Note Assigned Rents

State whether or not the borrower will connect rent on the property.

Step 6 – Enter Acceleration Upon Default

Write the number of days the borrower can default before the lender can accelerate the loan.

Step 7 – Check the Power of Sale Option

Specify whether the lender can foreclose and sell the property without going to court in the event of default.

Step 8 – Choose Mortgage Insurance Preference

Note whether or not the borrower must have mortgage insurance.

Step 9 – Check the Ownership Transfer Option

Choose whether or not the lender can call the loan balance due and payable immediately if the borrower transfers property ownership.

Step 10 – Choose Assignment Option

State whether or not the borrower and lender can assign an interest in the property without the other party’s permission.

Step 11 – Note Governing Law

Choose the state’s law that governs the mortgage agreement.

Step 12 – Fill In Other Details

Include any other provisions you want in this mortgage deed.

Step 13 – Gather Signatures

Collect signatures of both parties and state whether or not a notary, public, or witness must acknowledge the agreement.