Free Quitclaim Deed Form

Use our Quitclaim Deed to quickly transfer property with no guarantee of clear title.

-

1

Choose a form

Browse and select the document you need

-

2

Answer Questions

Go through our builder and complete your form in 5 minutes

-

3

Download & E-sign

Receive your document in PDF or Word format

Create Document

Create Document

- Download as PDF and Word

- Access from desktop, tablet & mobile

- E-signature

- Yearly Updates & Notifications

A Quitclaim Deed is a type of deed used to transfer property. It conveys to the new owner the same title the old owner had. However, this can be risky because the old owner might not have any title to the land.

If that is the case, the new owner would not have any title.

The purpose of a quitclaim deed is to speed up the transfer process. It quickly transfers property titles without requiring much paperwork or costly fees.

If you transfer property with a quitclaim deed, abide by the laws in your jurisdiction.

What Is a Quitclaim Deed?

A quitclaim deed is a document buyers and sellers use to transfer a property’s title.

With this type of deed, the owner (called the grantor) gives no guarantees regarding the property to the buyer (called the grantee).

The buyer receives only the title the seller had. Any other competing titles still exist, as do the interests of joint owners.

Why Do You Need a Quitclaim Deed?

Warranty deeds, which protect the buyer’s title, can be costly and take longer.

On the other hand, quitclaim deeds provide only the same title the grantor had. For example, if the seller owns 50% of the property, so does the new buyer.

If the seller did not have the title to the property, then the buyer (even though they paid for the property) has no claim.

Why are quitclaim deeds used, then?

A quitclaim deed cleanly and quickly transfers the title from the owner to the buyer, saving time and money.

When Do You Use a Quitclaim Deed?

While quitclaim deeds carry a higher risk than warranty deeds, they have benefits in specific scenarios.

A quitclaim deed can be helpful in the following situations:

- Transfer between family members: A quitclaim deed is common in property transfer. You can quickly transfer ownership to relatives or a new spouse. Because the transfer is between family members or spouses, the grantee would likely have trust and necessary information regarding the title because they are getting it from their family.

- Divorce proceedings: A quitclaim deed is helpful to take someone’s name off property during a divorce quickly. This can make a difficult situation more manageable.

- Skipping probate: A quitclaim deed helps transfer ownership to a beneficiary instead of having the property go through probate after death.

- Rectifying a title defect: You can quickly correct mistakes in the title with a quitclaim deed. This will avoid the costly fees that would otherwise be required to correct the defect.

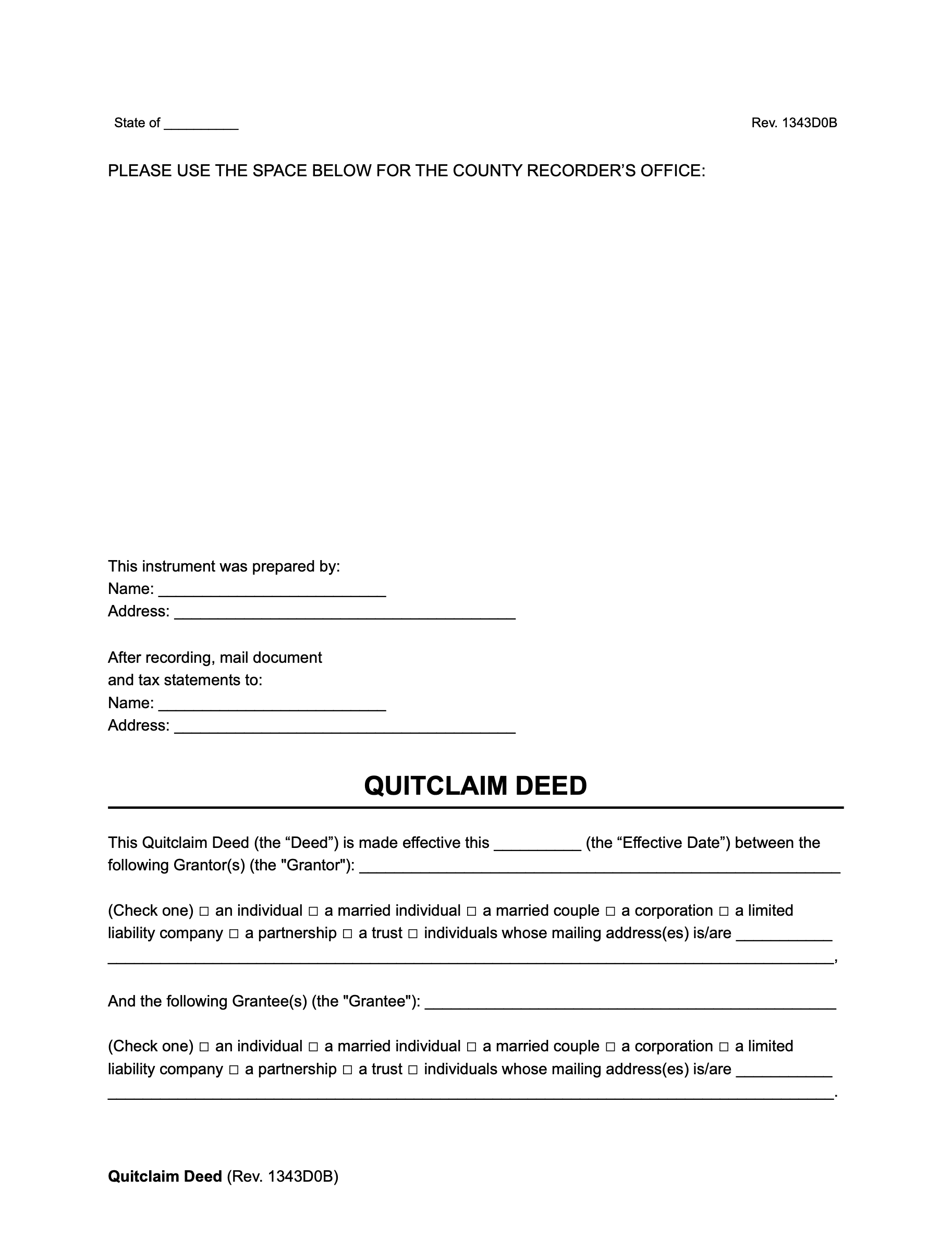

What to Include in a Quitclaim Deed

Every jurisdiction has its requirements for quitclaim deeds, but these are the most common elements:

- Name of the seller/grantor

- Name of the buyer/grantee

- The legal description of the property (like metes and bounds or lot and block)

- Consideration, or selling price of the property

- Signature of the grantor (usually, the grantor’s signature must be notarized)

- Date of the quitclaim deed

The term “quitclaim deed” must also be on the document. You can use a free quitclaim deed template to create your own or use our document builder to customize your deed.

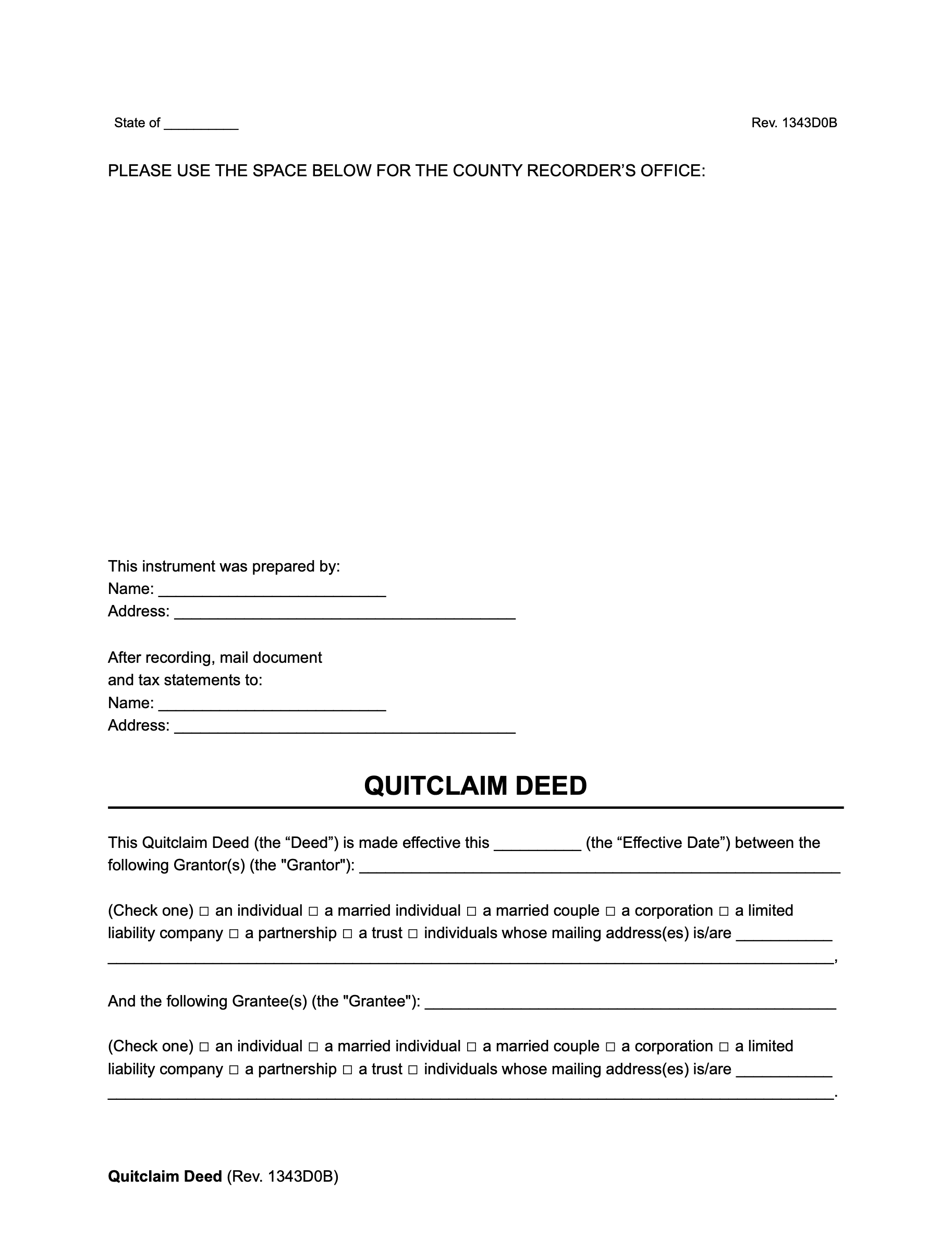

How to Write a Quitclaim Deed

Follow the steps below to write a quitclaim deed.

Step 1 – Include Grantor Information

Write the name and mailing address of the person or entity who owns the property and will transfer ownership.

Step 2 – Write Grantee Details

Enter the name and mailing address of the person or entity who will be the new property owner.

Step 3 – Note Consideration

Fill in the amount the grantee is paying for the property.

Step 4 – Document Location

Write the city and county the property is in.

Step 5 – Enter Legal Description

Describe the property in legal terms, words uniquely identifying a piece of real estate (typically noted on a prior deed).

Step 6 – Fill in the Parcel Number

Tax assessors assign a parcel number to a piece of property (usually listed on a property tax statement).

Step 7 – Write Preparer Details

Enter the name and mailing address of the person preparing this document.

Step 8 – Collect Grantor and Grantee Signatures

The grantor and grantee must have signatures and the date of signing on the quitclaim deed (some states do not require the grantee to sign).

Step 9 – Gather Witness Signatures

Depending on the laws of your state, you may need to have up to two witnesses sign the deed.

Step 10 – Get Deed Notarized

Check with your state to see if you need a notary public to verify signatures on the deed.

In addition to these basic steps to writing a quitclaim deed, you may want to include information about the following:

- Easements

- Encumbrances

- Life Estate

- Mineral Rights